Tradedragon focuses on Support and Resistance. Here’s why.

There are 3 market players. LONGS, SHORTS and the UNCOMMITTED.

LONGS have already committed to buying and owning shares, SHORTS have already shorted shares, and the uncommitted are those who are waiting to enter the market.

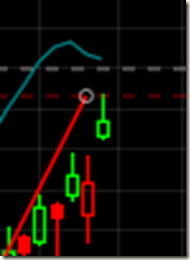

Assume that the market bounce on a support area. Longs are excited, and regretted not having bought more. If the market dips near the support again, they will buy more. Short realized that they are wrong, so if the market dips to that area, they will want out. The uncommitted decides to buy on the support to make a gain on the trade.

All 3 groups have decided to enter the market on the long side. “Buying the dip”. Naturally, if prices decline near that support, these people will buy again and thus push prices up.

The BUY orders create this support level.

The higher the volume near the support, the more significant it becomes as it means that more people have a vested interest in that area.

Now when the market goes below the support, the opposite happens. All the groups change their positions. Longs realized their mistake, Shorts are excited and want to short more , and uncommitted traders decide to short the market.

So what were buy orders at first, became sell orders. This is why SUPPORT becomes RESISTANCE.

This is why chart patterns work. They are due to the psychology of the market participants and their reactions to market events.

Charting and technical analysis are studies of reactions of traders.