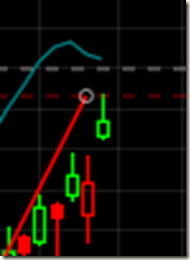

The shooting star is a small real body characterized by a long upper shadow, which gaps away from the prior real body.

The Shooting Star tells us that the market opened near its low, then prices strongly rallied up and finally prices moved down to close near the opening price. In other words, the rally of the day was not sustained.

A confirmation on the third day is required to be sure that the uptrend has reversed. The confirmation may be in the form of a black candlestick, a large gap down or a lower close on the next trading day.

In the above example, you could see that a shooting star was formed 2 trading days ago, but failed, the current shooting star is stronger as the real body is much smaller.

No comments:

Post a Comment